While TaxaBall has previously detailed how the “jock tax” works, the general “jock tax” calculation is relevant for this discussion and repeated below.

“Jock Tax” Overview

Like all US citizens, professional athletes must pay both federal and state income taxes. However, under what is commonly referred to as the “jock tax”, professional athletes pay state income tax in each state they play. The legal theory is that you are required to pay state income taxes in the state you earn that income and thus the professional athletes earn income in the stadiums they play in each season. But how much income does an athlete “earn” in each state? Does a player earn their money only by playing games or do they earn their money when practicing, making media appearances, off-season workouts, etc.?

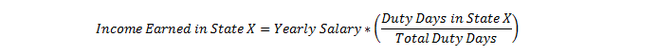

To solve this problem, states have generally adopted what is known as the “duty day” method to calculate how much income athletes earn in their state. This method is calculated as the percentage of duty days spent in the respective state compared to the total duty days that athlete had that season multiplied by the player’s salary.

“Jock Tax” Overview

Like all US citizens, professional athletes must pay both federal and state income taxes. However, under what is commonly referred to as the “jock tax”, professional athletes pay state income tax in each state they play. The legal theory is that you are required to pay state income taxes in the state you earn that income and thus the professional athletes earn income in the stadiums they play in each season. But how much income does an athlete “earn” in each state? Does a player earn their money only by playing games or do they earn their money when practicing, making media appearances, off-season workouts, etc.?

To solve this problem, states have generally adopted what is known as the “duty day” method to calculate how much income athletes earn in their state. This method is calculated as the percentage of duty days spent in the respective state compared to the total duty days that athlete had that season multiplied by the player’s salary.

A duty day is generally defined as a day when an athlete participates in any form of team activity. This includes official offseason workouts, playoff games, preseason games, travel days, team media appearances, etc.

While the duty day method is used by most states, it is not used by all states. For example, Tennessee used to charge a flat fee for their “jock tax”, and Cleveland, OH currently utilizes a “games played” method. Arizona, as detailed below, is another state who uses a unique approach to calculate how much income is earned by professional athletes in Arizona.

Arizona’s “Duty Day” Approach

Instead of defining a duty day as any day when an athlete participates in any form of team activity, Arizona defines a duty day as “all days during a taxable year from the beginning of a professional athletic team’s first regular game of the season through the last game in which the team competes.”

While calculating duty days from the first regular season game may not seem significant, this small change in calculation didn't happen by mistake. To understand why, it is necessary to understand the history of professional sports teams in Arizona.

States did not begin to focus on professional athletes as a large source of tax revenue until the 1990’s. Arizona, in particular, didn't provide the regulation quoted above until 2001. At the time Arizona implemented this regulation, they were quite inexperienced with taxing professional athletes. Unlike California who had already been taxing professional athletes for decades, Arizona had only had an MLB team for 3 years, an NHL team for 5 years, an NFL team for 13 years and their NBA team for a little over 30 years. So why would a state with little experience taxing professional athletes create a regulation so specific?

While the duty day method is used by most states, it is not used by all states. For example, Tennessee used to charge a flat fee for their “jock tax”, and Cleveland, OH currently utilizes a “games played” method. Arizona, as detailed below, is another state who uses a unique approach to calculate how much income is earned by professional athletes in Arizona.

Arizona’s “Duty Day” Approach

Instead of defining a duty day as any day when an athlete participates in any form of team activity, Arizona defines a duty day as “all days during a taxable year from the beginning of a professional athletic team’s first regular game of the season through the last game in which the team competes.”

While calculating duty days from the first regular season game may not seem significant, this small change in calculation didn't happen by mistake. To understand why, it is necessary to understand the history of professional sports teams in Arizona.

States did not begin to focus on professional athletes as a large source of tax revenue until the 1990’s. Arizona, in particular, didn't provide the regulation quoted above until 2001. At the time Arizona implemented this regulation, they were quite inexperienced with taxing professional athletes. Unlike California who had already been taxing professional athletes for decades, Arizona had only had an MLB team for 3 years, an NHL team for 5 years, an NFL team for 13 years and their NBA team for a little over 30 years. So why would a state with little experience taxing professional athletes create a regulation so specific?

As far back as the 1929 Detroit Tigers, MLB teams have been conducting Spring Training in Arizona. In 2000, when this rule was being considered, all 30 MLB teams conducted spring training in only two states - Florida or Arizona. Of course Florida doesn't collect income tax at all. Therefore, had Arizona decided to adopt the traditional duty day calculation that most states have adopted they would be collecting 4.54% of every MLB player’s salary during spring training while teams training in Florida would have been playing tax free. Fearful that players and teams would move their spring training locations to Florida (or another state that doesn't charge income tax e.g. Texas), Arizona valued the economic impact that spring training brings them over the economic impact taxing MLB player’s salaries would bring Arizona.

This is a big win for MLB players because regardless of which team they play for, they are not taxed for state income taxes on at least 20% of their salary each year. How big of an impact does this Arizona regulation have? Had Arizona taxed the 15 MLB teams that have Spring Training in Arizona they would have received an estimated $14MM in tax revenue in 2013.

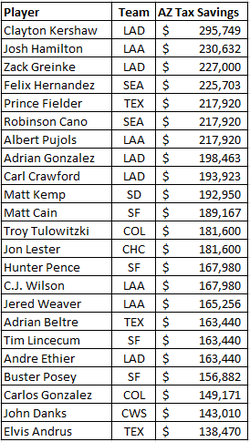

To the right is a list of the MLB players who will save the most money by Arizona not taxing income earned in Spring Training.[1]

To the right is a list of the MLB players who will save the most money by Arizona not taxing income earned in Spring Training.[1]

Interested in keeping up with TaxaBall? Follow us on twitter or get new posts delivered to your inbox!

RSS Feed

RSS Feed